Advantages of Variable Costing Include Which of the Following

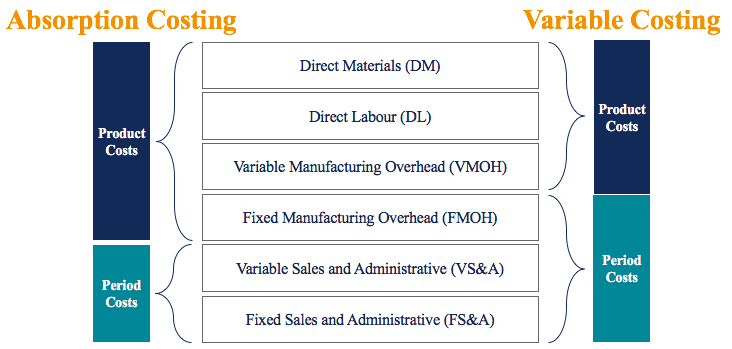

Absorption costing considers all costs connected with the production. Variable costing also called direct costing or marginal costing is a method in which all variable costs direct material direct labor and variable overhead are assigned to a product and fixed overhead costs are expensed in the period incurred.

Data that are required for CVP analysis can be take directly from the contribution margin format income statement.

. Full product cost recovery. Fewer changes to inventory costs will result in a better historical record of actual production costs. All things being equal profit for the period is.

Advantages of Variable Costing. Advantages of Variable Costing. A Tool for Management.

Under variable costing the other option for costing only the variable production costs are considered. Variable costing means the method of costing in which the costs to be inventoried is the variable manufacturing costs. It is rightly contented that the best or optimum price is that which produces the maximum excess of total sales revenue over total cost.

All things being equal profit for the period is not affected by changing inventories. Absorption costing includes all the costs associated with the manufacturing of a product while variable costing only includes the variable. The following are the advantages of variable costing.

Advantages of the full-cost method for determining transfer prices include all of the following except that it. Estimating future profits is often easier with variable costing when compared to absorption costing. In accordance with the accounting standards for external financial reporting the cost of inventory must include all costs used to prepare the inventory for its intended use.

D All of the above. Assessing all production expenses. Some of the advantages are given below.

Advantages Variable costing provides a better understanding of the effect of fixed costs on the net profits because total fixed cost for the period is shown on the income statement. Advantages of Absorption. The advantages of incorporating full product costs in pricing decisions include all the following except Ease in identifying unit fixed costs with individual products.

B All things being equal profit for the period is not affected by changing inventories. Advantages of variable costing include which of the following. Leads to better external pricing based on cost behaviors.

Cost-volume-profit relationship data needed for profit-planning purposes are readily available from the regular accounting records and statements. 1 Under variable costing method the contribution margin is calculated by taking only the variable cost incurred by the company in order to make the sales and therefore the major advantage of using variable costing is that the data from the variable. It is easier to estimate the profitability of segments of the business.

Advantages of variable costing include which of the following. Data that are required for CVP analysis can be take directly from the contribution margin format income statement. Overhead costs such as rent and wages are treated separately.

Following we have listed crucial advantages of Absorption Costing. All of the above. Various methods of controlling costs such as standard costing system and flexible budgets have close relation with the variable costing.

It helps in focusing on those costs only which are variable and directly impacted by the change in volume of production. Variable costing provides a better understanding of the effect of fixed costs on the net profits because total fixed cost for the period is shown on the income statement. Here fixed overhead costs are treated as the period cost along with the selling and administrative expenses incurred during the particular period.

Variable costing can readily supply data on variable costs and contribution margin which management needs each day to make decisions relating to special order expansion of capacity shut-down of production etc. Avoiding the Impact of Fixed Costs. The advantages of using variable costing in internal reporting include following except.

Inventory xxx xxx Less. Decision Making and Absorption costing External Reporting and Income Taxes Advantages of Variable Costing and the Contribution Approach Variable versus Absorption Costing Variable Costing and. Advantages of Absorption Costing.

Performance Evaluation of Managers. Absorption Costing vs. Inventory Changes do not Affect Profit.

It further makes it a useful. Variable costing provides more useful information to management for pricing decisions than absorption costing. The profit for a period is not affected by changes in inventories.

A Data that are required for CVP analysis can be taken directly from the contribution margin format income statement. Why would a company choose variable costing over absorption costing. QUESTION 5 Advantages of variable costing include which of the following.

As you can see variable costing plays an important role in decision-making. Under variable costing fixed overhead is not included in the value of inventory. Fixed Overhead in Ending Inventory xxx Variable Costing Net Income xxx Advantages of Variable Costing The arguments for variable costing include the following.

Prots tend to move in the same direction as sales. Various methods of controlling costs such as standard costing system and flexible budgets have close. The advantages of variable costing can be summarized as follows.

Why Variable Costing is not Permitted in External Reporting. Leads to goal congruence among departments. What are the advantages of Variable costing.

C Profits tend to move in the same direction as sales. Following are the main advantages and disadvantages of variable costing system.

/dotdash-INV-final-Absorption-Costing-May-2021-01-bcb4092dc6044f51b926837f0a9086a6.jpg)

/dotdash-INV-final-Absorption-Costing-May-2021-01-bcb4092dc6044f51b926837f0a9086a6.jpg)

Comments

Post a Comment